Nationwide's coverage is more pricey than many of the various other business on the listing, this firm does offer some of the cheapest research rates for chauffeurs with reduced debt scores - cars. Of the firms on this listing, the depictive insurance policy rates from Progressive are the fifth cheapest. Based upon the vehicle driver accounts used, the study price is $1308 per year.

Extra Pricey Cars And Truck Insurance Coverage Companies, In our evaluation, the automobile insurance rates offered by Farmers are substantially higher than standard. credit. The research study rate is $1538 per year, making Farmers the second-most costly firm in our research study. We found that State Farm is the second-most pricey total among the nine significant vehicle insurance provider on the listing (cheaper).

Based upon various chauffeur profiles, the research study rates for Allstate are $1778 annually. This expense is about $450 over the nationwide ordinary price in the research - affordable auto insurance. It is almost $900 above the rate from USAA, the cheapest automobile insurance business in our research study. cheaper car. Regional and Regional Firms, When contrasting automobile insurance prices, it is very important to be aware that not all business supply insurance policy throughout the country.

This optimal consumer would certainly allow the insurance firm to make an earnings since they are likely to pay their premiums without making pricey cases on their policy. Exactly how to Lower Your Rate, If you desire to lower your insurance coverage rates, search for price cuts with the numerous insurance policy firms. vehicle insurance. You can ask your insurance representative about what price cuts are readily available, as the company might use price cuts that you are eligible to receive however are not capitalizing on on your policy.

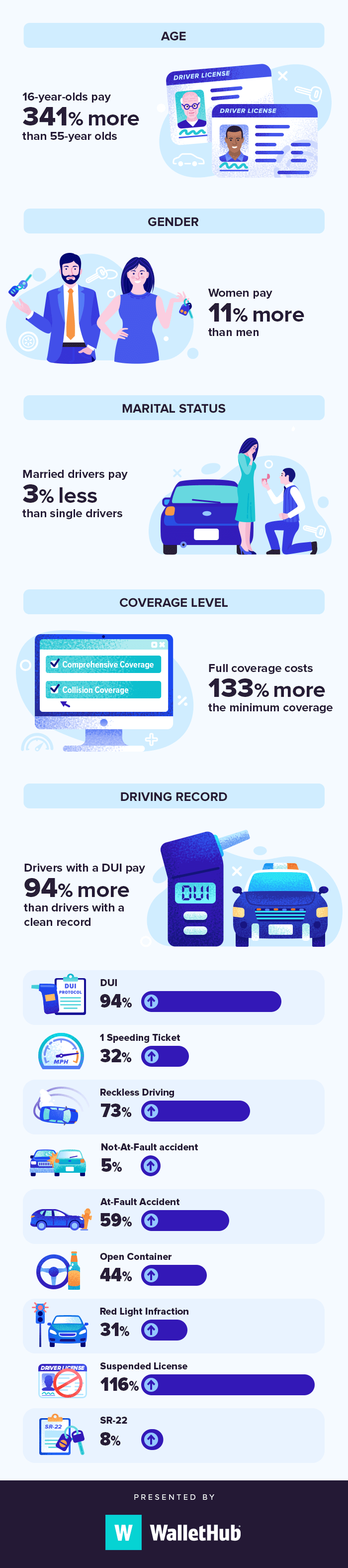

When requesting vehicle insurance prices estimate from numerous carriers, make certain to request for all price cuts that are available to you. Web Traffic Infractions and also Insurance Coverage Prices, When a driver account has one speeding ticket, the study prices start to rise. This relationship is because of the reality that vehicle drivers that speed up are more probable to be involved in crashes.

cheapest car low cost auto insurance affordable cheap car

cheapest car low cost auto insurance affordable cheap car

cheap auto credit low-cost auto insurance

cheap auto credit low-cost auto insurance

If a driver profile has an accident, the prices increase even much more. USAA is still the lowest-priced option for vehicle drivers with an accident, yet their prices boost by around $320 per year over a motorist without an accident on their record. read more The typical boost in the research prices for motorists with a mishap throughout all business on the listing is $300 each year.

The Main Principles Of How To Find Cheap Auto Insurance Rates Online (2022)

This is since vehicle drivers who drive while intoxicated are at an incredibly high risk of causing an accident. The motorist profile utilized in our study with a DUI showcases just how specific insurance policy business penalize this violation much more than others (low cost auto). Although Geico is the second-cheapest general in our analysis, the prices for the account with a drunk driving are several of the greatest in the study.

low cost auto car insured cheap auto insurance cheapest car

low cost auto car insured cheap auto insurance cheapest car

The accounts utilized in our research with excellent debt qualified for a typical rate of $1306 each year, while the average yearly price for accounts with poor credit score was $2318. Details and study in this short article confirmed by ASE-certified Master Technician of - low cost. For any responses or adjustment demands please call us at.

affordable car insurance car insurance cheaper cars prices

affordable car insurance car insurance cheaper cars prices

You might have the ability to discover even more info about this and also comparable web content at. cheaper.

2 of the most affordable auto insurer at a nationwide level are GEICO and also USAA. Various other cheap cars and truck insurance policy options include smaller insurers like Grange as well as Erie. You ought to collect insurance coverage quotes from several insurance providers to locate the most affordable policy.

insurance affordable cheapest car car suvs

When seeking the most affordable cars and truck insurance coverage, you may begin with USAA, Erie Insurance, Root Insurance Policy, Geico, and State Ranch. Based on our thorough study, these firms all offer affordable costs. auto. Listed below, we look at average prices and also coverage options to assist you discover the finest car insurance company for your needs. cheaper car insurance.

Along with the insurer you select, variables such as your age, automobile, and driving background can impact your costs. What Is The Cheapest Automobile Insurance Business? According to our rate quotes, USAA has a tendency to be the most affordable provider total with complete insurance coverage on standard - vans. This quote uses to 35-year-old great drivers with great credit report.

The smart Trick of Europcar: Car Rental - Rent A New Car & Van Worldwide That Nobody is Discussing

Best Low-cost Vehicle Insurance Companies In our research of the cheapest automobile insurance provider, we discovered a number of business with fairly reduced prices (cheapest). While a few other vehicle insurer give inexpensive automobile insurance, we are going to concentrate in this article on the 5 discussed above. These companies have the most effective prices for minimum auto insurance policy protection as well as the most inexpensive complete insurance coverage insurance policy. cheapest car.

Power Vehicle Insurance policy Study recommends Erie is a leader wherever insurance coverage is sold - insured car.: You stay in a protected state You have had an at-fault crash Your credit scores score is excellent To read more regarding this economical auto insurance policy carrier, inspect out our Erie vehicle insurance coverage testimonial. # 3 Root Insurance: Ideal Usage-Based Insurance Policy Root Insurance Pros Origin Insurance coverage Cons Wonderful rates forever vehicle drivers Might deny insurance coverage based on your driving actions Every little thing is done via a mobile application, producing a straightforward quotes and cases procedure Only available in 29 states Includes roadside assistance No individual insurance policy representatives assigned to your plan A+ ranking from the BBB Young company compared to others in the industry Root Insurance coverage is a bit various from various other insurance providers - cheapest.

To obtain a quote from Origin Insurance policy, your driving actions initially needs to be taped via the Origin mobile app, which can take a number of weeks. Considering that Origin gives coverage only to excellent vehicle drivers, it pays out less commonly, making it among the most inexpensive automobile insurance providers. Root can reject coverage if you aren't a good vehicle driver (business insurance).

Perks supplied by Geico include roadside support, ridesharing insurance, and mechanical malfunction coverage. In enhancement, the business has an A+ score from the BBB, plus it racked up extremely in the J.D.However, State Farm is not rated by the BBB at this time. State Farm provides Drive Safe & Save Discounts to aid you keep more money in your pocket (auto).